GTA Realtors Report January Resale Housing Figures

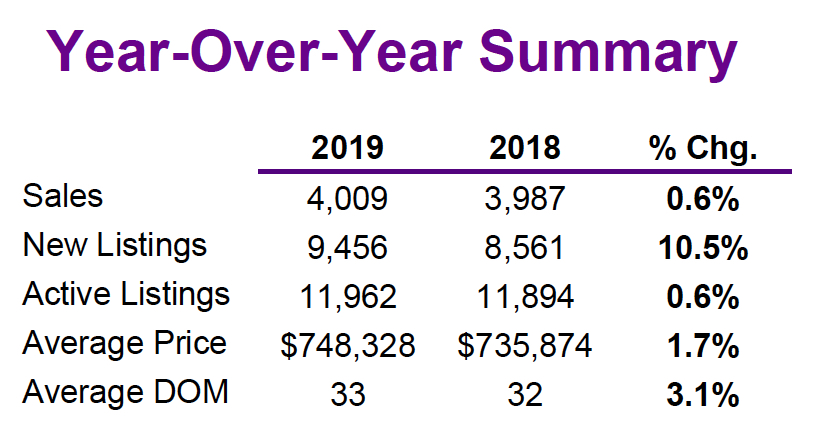

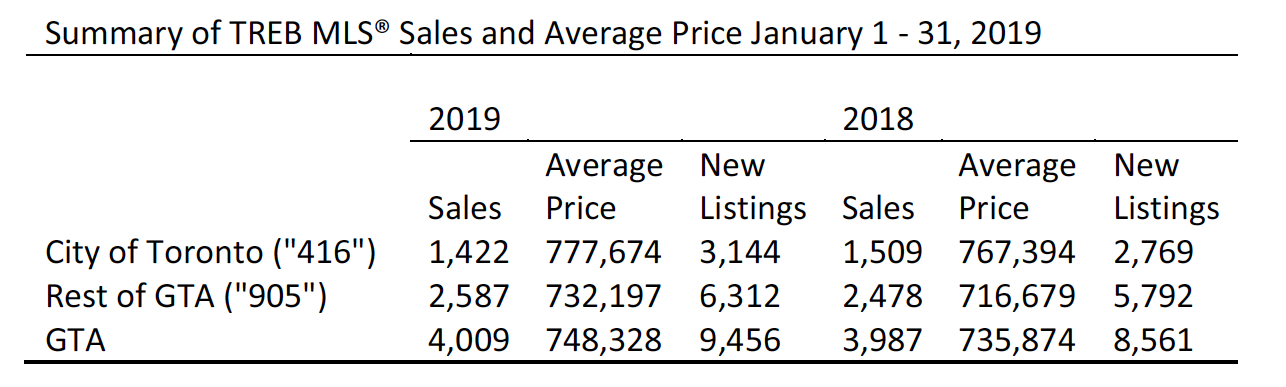

TREB President Garry Bhaura announced that Greater Toronto Area REALTORS® reported 4,009 home sales through TREB’s MLS® in January 2019 – up by 0.6 per cent compared to January 2018. On a preliminary seasonally adjusted basis, sales were up by 3.4 per cent compared to December 2018.

“It is encouraging to see the slight increase in January transactions on a year-over-year basis, even with the inclement weather experienced in the GTA region during the last week of the month. The fact that the number of transactions edged upwards is in line with TREB’s forecast for higher sales in calendar year 2019,” said Mr. Bhaura

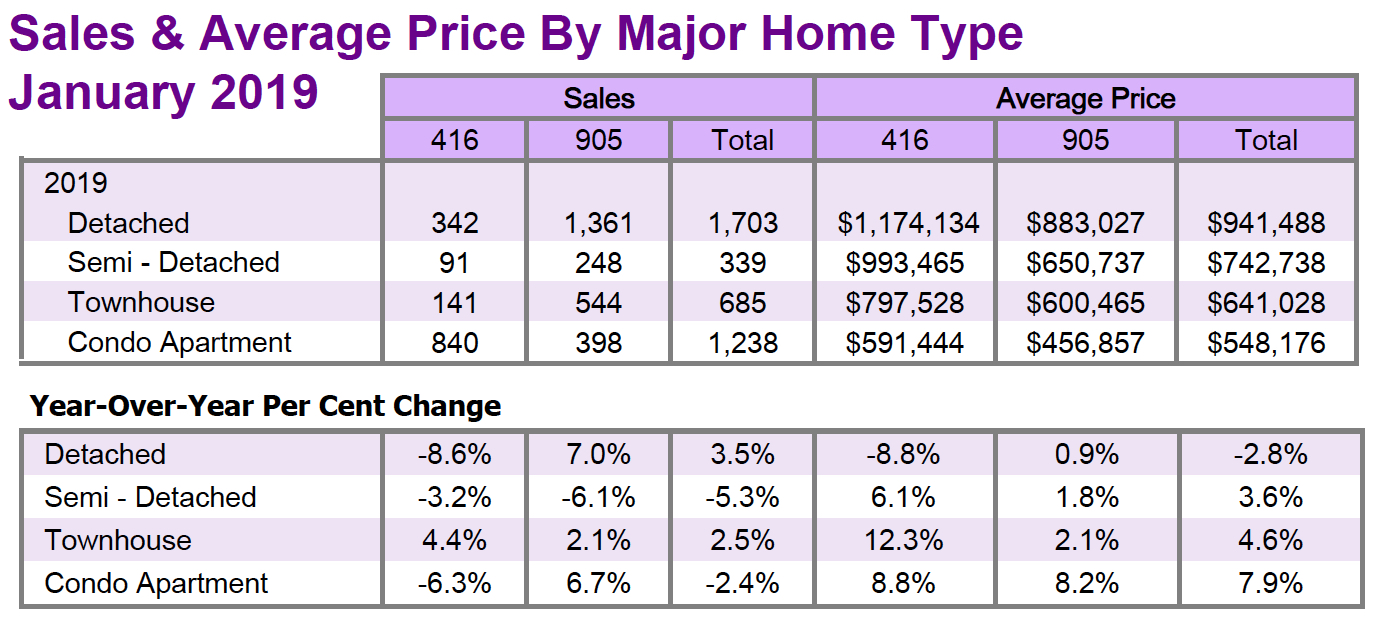

The MLS® HPI Composite Benchmark price was up by 2.7 per cent compared to January 2018. The condominium apartment market segment continued to lead the way in terms of price growth. The average selling price was up by 1.7 per cent on a year-over-year basis. After preliminary seasonal adjustment, the average selling price edged lower compared to December 2018.

“Market conditions in January, as represented by the relationship between sales and listings, continued to support moderate year-over-year price increases, regardless of the price measure considered. Given housing affordability concerns in the GTA, especially as it relates to mortgage qualification standards, we have seen tighter market conditions and stronger price growth associated with higher density low-rise home types and condominium apartments, which have lower average selling prices compared to single detached homes,” said Jason Mercer, TREB’s Director of Market Analysis and Service Channels.

2019 Outlook Summary

The following points summarize TREB’s outlook for 2019 and results of the Ipsos Home Owners and Home Buyers surveys:

• 83,000 sales are forecast to be reported through TREB’s MLS® System in 2019 – a moderate increase compared to 77,375 sales in 2018. This moderate increase will be underpinned by an uptick in the number of people considering a home purchase, as reported by Ipsos, which will be supported by continued population growth, low unemployment rate and lower average fixed-rate borrowing costs compared to 2018.

• Slightly tighter market conditions, similar to those observed in the second half of 2018, will support a moderate pace of price growth in 2019. The average selling price in the Greater Toronto Area will increase to $820,000 – close to the peak reached in 2017 and up from an average of $787,195 in 2018. The condominium apartment market segment will continue to be the driver of price growth, whereas average detached home price growth will be below the average growth rate for the market as a whole.

• Ipsos results confirm that the OSFI-mandated mortgage stress test has negatively impacted affordability. TREB analysis found that, on average, home buyers had to qualify for monthly mortgage payments almost $700 above what they will actually pay. In order to account for the higher qualification standard, intending home buyers have adjusted their preferences, including the type of home they intend on purchasing. The Ipsos Home Buyers Survey found that the share of buyers intending to purchase a detached home is at the lowest level since the fall survey was introduced in 2015. Higher density home types, which have a lower price point on average, have become more popular with intending buyers.

• Notwithstanding the brief spike in 2017, new listings entered into TREB’s MLS® System receded back to the post-recession norm in 2018, hovering between 155,000 and 156,000. The expectation is that the new listing trend will remain relatively flat in 2019. The Ipsos Home Owners Survey pointed to a slight dip in listing intentions this year.

• The rental market in the GTA is expected to remain tight in 2019, with low vacancies underpinning annual average rates of rent growth in the high single-digits or even low double-digits for one-bedroom and two-bedroom condominium apartments leased through TREB’s MLS® System. The supply of rental units could continue to be problematic in 2019. The Ipsos Home Owners Survey found that almost two thirds of investor-owners are thinking about selling one or more of their units over the next year. The existence of rent controls on these units could arguably be prompting this thought process.

Click HERE for TREB’s January 2019 Market Watch Report.

Click tables below to enlarge:

Source: Toronto Real Estate Board