Agreement of Purchase and Sale – Clause Explanations

You have found the perfect home – one that satisfies your needs, most of your wants… and best of all, fits your pocketbook. Now it’s time to submit an offer, but understanding the Agreement of Purchase and Sale is essential towards successfully completing your house hunting expedition.

Essentially, the offer is a precisely worded document that sets out the terms and conditions between the buyer and the seller. Once the offer is made and accepted, and after any conditions of the offer are met, the offer becomes a legally binding contract – meaning that the buyer and the seller are obligated under law to hold up to their ends of the agreement and complete the transaction. For that reason, you must be very sure you understand what is in the offer before you sign it.

A properly drafted offer should leave no room for interpretation. It should contain everything that is important to you about the home and the transaction. For example, if the MLS Listing states that the washer and dryer are included in the sale, put that fact into the offer. How about that satellite dish in the backyard? If you want to be sure it’s sold with the house, say so in your offer. Having a written agreement detailing these issues will avoid future complications.

Preparing the offer:

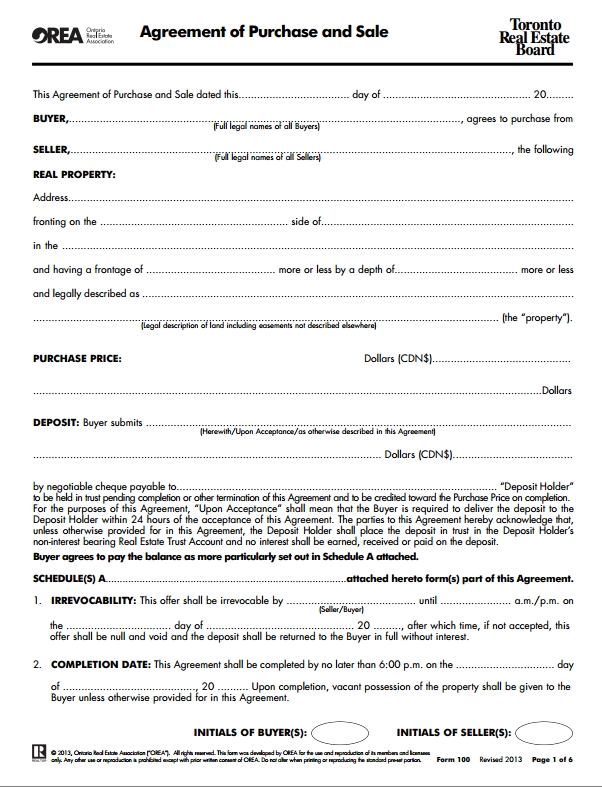

If this is the first time you’ve purchased a home, you probably have never seen the Agreement of Purchase and Sale (Freehold or Condo) form before, let alone a drafted one. Not to worry. Fortunately, Realtors don’t have to reinvent the wheel every time there’s an offer to be drafted. Standard forms are used by almost ALL Real Estate Boards. The wording on these forms has been thoroughly reviewed and tested through the legal system, and is broadly accepted.

If this is the first time you’ve purchased a home, you probably have never seen the Agreement of Purchase and Sale (Freehold or Condo) form before, let alone a drafted one. Not to worry. Fortunately, Realtors don’t have to reinvent the wheel every time there’s an offer to be drafted. Standard forms are used by almost ALL Real Estate Boards. The wording on these forms has been thoroughly reviewed and tested through the legal system, and is broadly accepted.

That doesn’t mean, however, that your specific offer cannot also include special conditions. Every sale/purchase is different, and your offer will contain the wording that suits your needs.

Here’s a closer look at some of the specific areas in the Agreement that will be custom tailored to fit your specific needs.

Purchaser/Buyer: That’s you (unless you are selling the home). If you’re buying the property with a spouse or other partner, each of your names should be listed exactly as you will want them to appear on Title.

Vendor/Seller: That’s the seller. If jointly owned, each seller’s name should be listed in full, exactly as shown on Title.

Real Property: This is the exact legal description of the property you intend to purchase. It should include the postal address, lot and plan number, as well as frontage and depth dimensions. The Realtor and lawyer will make sure the property description is specific and accurate.

Purchase Price: The price you are offering for the property.

Deposit: When you submit an offer, normally you are requested to include a deposit to demonstrate a serious intent to buy the property. This deposit will usually be in the form of a certified cheque, payable to the listing broker, who will place it in a trust account until the sale is completed or terminated.

NOTE: the deposit is not the same thing as the downpayment. The deposit forms part of the downpayment. When an agreement is reached and the transaction is competed, the deposit will be credited in full towards the purchase price. There is no standard amount for a deposit, but the size of your deposit says something about how serious you are about buying the home.

Clauses particular to the agreement: Every transaction is unique, so space has been provided (sometimes on a separate Schedule) for any provisions that apply specifically to your offer. Conditions are generally inserted at your request and for your protection. If a condition is not satisfied within the specified time period, your offer is not longer valid.

Chattels included and Fixtures excluded: In order to attract buyers, it is common for sellers to include in the selling price some chattels that are not normally considered part of the dwelling itself. These are MOVABLE pieces of personal property. Some examples are fridges, stoves, washer, dryer, microwave ovens and these chattels are listed as items to be included with the sale.

Fixtures are permanent improvements to a property that normally stay with the property as part of the sale. However, it isn’t always clear what constitutes a fixture or whether it will stay. For example, the seller will naturally want to retain a dining-room chandelier that is a family heirloom. Since the chandelier could be defined as a fixture, it SHOULD be listed as an exception in the offer. From a legal standpoint, if it is a fixture and not mentioned in the agreement as an exclusion, it is then considered part of the purchase price.

If there is any doubt in your mind as to whether chattels are fixtures and part of the agreement, specifically list the items you are concerned about in writing in your offer. Where appropriate, give make and model numbers, or describe the items by colour and location. Leave nothing to chance. You will avoid surprises later, when you take possession of the home.

Irrevocability of the offer: This is the period during which you leave the offer open for consideration by the seller/buyer. If you are not notified before the precise time and date specified that your offer had been accepted, the offer becomes “null and void” (no longer valid). The Realtor will assist you in determining how long you should let the seller think about your offer.

Completion Date: This date, often referred to as the “closing date” is the glorious day when the parties expect to complete the transaction. All documentation is filed, all monies are paid out – and the property is yours. Closing dates are often scheduled for 30-60 days from the date of the agreement (and some as long as 90 days unless it is a new home and this date could be substantially longer), although this period will vary with circumstances.

Time to examine title: When buying a home, you are really paying for ownership rights that go along with it. The “title” is the legal evidence of ownership, and you want to be sure your lawyer has time to search the seller’s title to make sure it is free of restrictions. If the seller’s doesn’t have title to clear ownership, there may be complications in transferring title to you on the closing date. Your lawyer should be given ample time (stipluated in the agreement) to search title prior to completing the transaction. Also speak to your Realtor and lawyer about Title Insurance.

Involve Your Lawyer: You may want to have your lawyer review the offer before you sign and submit it to the seller. Why? Because when it’s all said and done, you and the seller are legally responsible for what the offer says.

If you believe you will miss an opportunity to buy a home because you have to wait for your lawyer to review the offer, there is a simple solution. Ask your Realtor to insert a clause stating that the agreement is conditioonal upon the review of the document by the buyer’s lawyer. Most lawyers are very responsive to your request and will certainly examine the offer right away.

Here are the plain language version of the Agreement of Purchase and Sale for Freehold and Condo.